It's PrivateOne thing that I've been interested in lately is an industry known as "private equity". I must say that its been in the news a lot lately. Especially after the biggest private equity deal in Australia with Kohlberg Kravis Roberts (KKR) buying a part of Brambles. There has also been rumours that the Coles supermarket might also be bought by KKR.

Everytime I pick up a financial newspaper or a business magazine, the phrase "private equity" is coming up more often. I'm not sure why I'm interested in it, but its definently more than a trend. It's becoming a lot more prominent in the business world.

I guess the starting point is - what is private equity?A lot of people get it confused with the term "venture capital" and perhaps even "hedge funds".

I would argue that private equity is a form of financing. It is commonly used when a company (typically an unlisted company) is seeking finance but might not be able to go down the traditional route and obtain a loan from a bank. What happens instead, is that a private equity firm would provide the finance in exchange for a controlling stake in the business. It might even buy 100% of the business and gain control of it.

The private equity firm would seek to shake things up in the company by streamlining operations, making the business more profitable, installing more appropriate management, basically restructuring the business.

The aim of all this is simple: it is to invest in the business for the medium term and exit in 5-10 years. Exit typically happens via:

- IPO (initial public offering),

- sale of the business to someone else e.g. management, another company, or even a another private equity firm.

To analogise, private equity (PE) is similar to a property investor who buys a bargain house and renovates it, hoping to resell it at higher price in 5-10 years. The difference is that your buying a business instead of a house. Private equity houses usually seek to buy an underperforming business at a discount, pump it full of debt finance, renovate and resell.

The reason that they have to resell in 5 to 10 years (or a similar approximate timeframe) is that they raise the money via funds from investors and must return the money to the investors in 5 to 10 years. Hence they must "unwind" all their investments after 5 years.

Private equity firms sometimes concentrate on a particular industry sector while the bigger ones simply buy any kind of business from health care, transport, consumer goods, etc... Half the time is spent looking after their current investments and the other half in originating new deals (e.g. scouring for new investments).

Venture CapitalPrivate equity is to be contrasted with venture capital (VC's) which typically seek to fund businesses in the earlier stage of the life cycle. You often hear about entrepreneurs going to VC firms to finance new business. I guess you could say that venture capital is a form of private equity aimed at start up businesses.

Usually these businesses backed by VC firms are in IT companies, biotechnology, health care or have higher risk profiles than your normal mom and dad type business. The reason is that your normal bank is not going to touch these types of businesses with a 10 foot pole. Financial institutions typically look for stable businesses with predictable returns. VC's and private equity houses are have a bigger appetitie to take on more risk for higher returns.

What makes VC's and PE finance attractive is the people that supply these finance offer more than just money. They are willing to get involved in the business and offer their expertise in finance, strategy, marketing or general business nous. That is why you find VC's and PE houses stocked with ex-investment bankers, strategy consultants and people with expertise in the fields that the houses specialise in (i.e. health care business managers in health care VC's).

The Major PlayersThe big US firms (i.e. the major players) in private equity are Kohlberg Kravis Roberts, Carlye Group, Blackstone, Texas Pacific Group and Bain Capital. In Australia, we have firms such as Ironbridge Capital, Allen & Buckeridge, Private Equity Partners, and Champ Ventures.

The biggest and most famous private equity buyout was by Kohlberg Kravis Roberts, who paid $33 billion dollars for the biscuit company

RJR Nabisco. It is by far the biggest amount of debt paid by a private equity firm which is never to be repeated again. They even made a book and a movie about it titled "Barbarians at the Gate" to emphasise the corporate greed of the 1980's.

From left to right: The other birthday boy (Ivan), Jerm, Abbi, Alvin who thinks he's drinking Dom P

From left to right: The other birthday boy (Ivan), Jerm, Abbi, Alvin who thinks he's drinking Dom P Self Titled Portrait: DJ Ho

Self Titled Portrait: DJ Ho We bringing sexy back: PJ and Sharon

We bringing sexy back: PJ and Sharon The DJ wearing his PJ's

The DJ wearing his PJ's

My chiropractor doesn't recommend this

My chiropractor doesn't recommend this

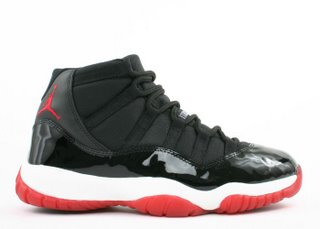

Air Jordan 11

Air Jordan 11 After the react juice blob fell out of the shoe's sole, I desperately took it to the shoe tailor and pleaded with him to repair it. Unfortunately, I was told it was too expensive to repair and was better off buying a new pair.

After the react juice blob fell out of the shoe's sole, I desperately took it to the shoe tailor and pleaded with him to repair it. Unfortunately, I was told it was too expensive to repair and was better off buying a new pair. Only recently, I have bought my first pair of sneakers that haven't been Nike. A flashy pair of And1's, the new shoe for wannabe ballers.

Only recently, I have bought my first pair of sneakers that haven't been Nike. A flashy pair of And1's, the new shoe for wannabe ballers.  Even though I don't have an extensive collection of sneakers, I still love the smell of fresh sneakers, reading about them, visiting the old Nike factory at Petersham (RIP), and now the one in Auburn. There's nothing like the feeling of walking into a store searching for a pair of cheap kicks.

Even though I don't have an extensive collection of sneakers, I still love the smell of fresh sneakers, reading about them, visiting the old Nike factory at Petersham (RIP), and now the one in Auburn. There's nothing like the feeling of walking into a store searching for a pair of cheap kicks. Air Jordan 1 Retro

Air Jordan 1 Retro

Racism still alive they just be concealing it/

Racism still alive they just be concealing it/  This picture is taken from a website which orginally took it from the Loft website. How's this for publicity?

This picture is taken from a website which orginally took it from the Loft website. How's this for publicity? More pictures of the dungeon known as the Loft

More pictures of the dungeon known as the Loft

Charlie Murphy! Scruffy Murphy! An uber high class bar in the Chinatown precint

Charlie Murphy! Scruffy Murphy! An uber high class bar in the Chinatown precint

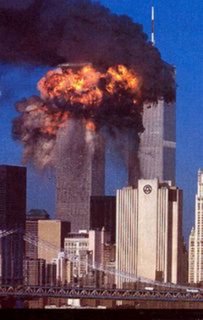

Today's date probably doesn't mean anything. It's September 10, 2006. In a few hours tomorrow will come and mark the anniversary of one of man kind's most tragic days. The day that the skies of New York were filled with smoke, ash and the smell of death in the air. The day that the world trade centre came crumbling down (for the second time), and with it the lives of thousands of people. The day that New York, America and the world was never the same again.

Today's date probably doesn't mean anything. It's September 10, 2006. In a few hours tomorrow will come and mark the anniversary of one of man kind's most tragic days. The day that the skies of New York were filled with smoke, ash and the smell of death in the air. The day that the world trade centre came crumbling down (for the second time), and with it the lives of thousands of people. The day that New York, America and the world was never the same again. I come now to the crux of my post: Did the world change on September 11, 2001? Without a doubt it did. The loss of life and the destruction of one of New York's icons shook the Western world to its core. I mean it was New York that was being attacked! America's homeland became the new doorstep of terrorism activity. American lives would never be the same again.

I come now to the crux of my post: Did the world change on September 11, 2001? Without a doubt it did. The loss of life and the destruction of one of New York's icons shook the Western world to its core. I mean it was New York that was being attacked! America's homeland became the new doorstep of terrorism activity. American lives would never be the same again.  But it was more than that. It affected people in other nations. We came to the stark realisation that a terrorist attack could happen anywhere, anytime. Suddenly New York and major tourist destinations didn't become such "hot" destinations. In the back of our minds, plane travel became a lil different. We became suspicious of people of Middle Eastern appearance. Fear and hatred develped a heightened sense of racism towards anything associated with Arabic people.

But it was more than that. It affected people in other nations. We came to the stark realisation that a terrorist attack could happen anywhere, anytime. Suddenly New York and major tourist destinations didn't become such "hot" destinations. In the back of our minds, plane travel became a lil different. We became suspicious of people of Middle Eastern appearance. Fear and hatred develped a heightened sense of racism towards anything associated with Arabic people.