Superannuation is a huge area and we don't know it. 9% of our salary is contributed by our employers on our behalf. You might not realise it, but your sitting on a huge nest egg. And its only going to grow. One ex-investment banker who owns a super fund, salivated as he told me, "its an area of legislated growth". It just has to keep growing because the government forces employers to contribute.

As the workforce grows and more people enter the workforce, superannuation fund are only going to grow. Due to people wishing to maintain their standard of living, they will voluntary sacrifice a proportion of their wages into superannuation. With an aging population, there will be increasing pressure on retirees to fund their own retirement and to rely less on government pensions.

The current status

The influx of money into Super means that these fund managers are sitting on millions if not billions of dollars. It just crazy the amount of money in Super at the moment. Funds under management are at all time high and will only exponentially increase. The entire Australian Super industry is estimated to be $700 AUD billion. That's a pretty big piggy bank.

And that's not even counting American, European, Asian Superfunds (well i dont think they have super in places like China). The famous Californian State Super Fund for government employees called CalPERS is phenemonal in size. At time of writing, it holds $210 US billion worth of stocks, bonds, and private equity. Even Australia has The Future Fund, for Australian government employee which currently has an accumulation of $90 billion in funds.

Bling Bling Baby $$$

The thing is, these Super fund managers have to stash their money somewhere.

You can't sit on $90 billion dollars - ask David Murray, head of the Future Fund. As I've stated in the past, to make money you have to make it work. Many Super Funds are run by professional fund managers and have benchmarks to beat, usually set to the overrall stock market movement. As a friend of mine who helps to construct superfund portfolios states, 'We just have to beat the stockmarket - by 2% or whatever".

At the end of the day, do we really know where our Super money goes? Of course not. You know which fund you put it in, but that money usually is invested into other funds. Which probably end up in a fund of funds (a much bigger fund), and then eventually is re-invested into stocks, bonds, property, etc...

The amount of money involved presents many opportunties. For fund managers, there is more money to play with. More money, means more transactions. More work for the investment professionals, for the lawyers that advise on the deals. For the tax and accounting people to provide their opinions. This vast accumulation of capital means some funds will try to grow even bigger in size (i.e. gain economies of scale) by merging, acquiring, perhaps even divesting.

Overall, this means that markets will be flush with money moving from once place to another, resulting in greater investment and transactional activity , and in turn cause greater risks to be taken by Superfunds as they venture outside their traditional investment boundaries.

The Rise of the Super Fund

Because of the amount of money involved, super funds are probably no longer going to be passive investors. They are big enough to directly invest - to buy and hold large chunks of public company shareholdings, buy significant stakes in property, be more involved in sophisticated investment deals. They are already big players in the marketplace, but only just got bigger.

We've seen the rise of the hedge fund in the 90's.

Are we now witnessing the rise of the Super fund?

I'm out like your 9%,

DJ Ho.

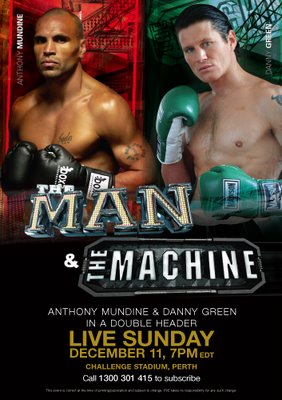

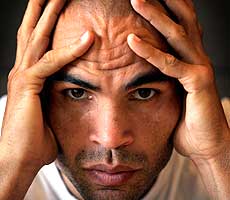

I must admit that I was a Mundine hater in the past. His cockiness, and bragging really annoyed me. But I must admit that he was at least interesting to watch and read about. He made Australian boxing interesting. Say what you may about Kosta Tzyzu, but if it wasn't Mundine, many people including myself wouldn't even bother actually watching a full fight.

I must admit that I was a Mundine hater in the past. His cockiness, and bragging really annoyed me. But I must admit that he was at least interesting to watch and read about. He made Australian boxing interesting. Say what you may about Kosta Tzyzu, but if it wasn't Mundine, many people including myself wouldn't even bother actually watching a full fight. Green's no slouch either. From what I hear, he was in absolutely devasting form two years ago in his controversial loss to Markus Beyer but he may have a lost a step or two. Still, you know that Danny wants this bad. He's been calling out Mundine for ages. I reckon Green's going to come out guns blazing, and try to rock Mundine with some body punches to test his toughness. He'll probably want to corner Mundine, and try to turn it into a slug fest.

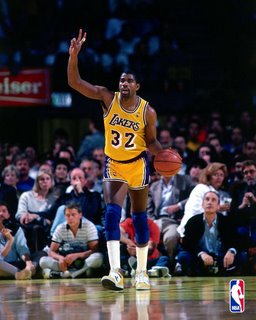

Green's no slouch either. From what I hear, he was in absolutely devasting form two years ago in his controversial loss to Markus Beyer but he may have a lost a step or two. Still, you know that Danny wants this bad. He's been calling out Mundine for ages. I reckon Green's going to come out guns blazing, and try to rock Mundine with some body punches to test his toughness. He'll probably want to corner Mundine, and try to turn it into a slug fest. One of the most famous pictures in boxing, taken from the roof of the stadium. It shows a young Muhammed Ali standing over Joe Frazier, from their first encounter dubbed "The Fight of the Century".

One of the most famous pictures in boxing, taken from the roof of the stadium. It shows a young Muhammed Ali standing over Joe Frazier, from their first encounter dubbed "The Fight of the Century".

The whole mix up in delivering the body also stinks. His family deserved better than to recieve the body of another solider. And to happen on the eve of Anzac day as well. I know that deaths that occur in war are not justified or should be glorified, but to go out this way - while cleaning your gun, I mean that is a really cruel way to die. I'm not sure if you get my point, but he wasn't killed in action i.e. fighting, he was killed in his room handling his own weapon.

The whole mix up in delivering the body also stinks. His family deserved better than to recieve the body of another solider. And to happen on the eve of Anzac day as well. I know that deaths that occur in war are not justified or should be glorified, but to go out this way - while cleaning your gun, I mean that is a really cruel way to die. I'm not sure if you get my point, but he wasn't killed in action i.e. fighting, he was killed in his room handling his own weapon.